Kicking off with the topic of best countries for affordable private health insurance, this opening paragraph aims to captivate readers with valuable insights on where to find cost-effective healthcare coverage.

Exploring the factors influencing insurance costs across different nations and the strategies to secure the best deals, this discussion sheds light on the importance of understanding private health insurance dynamics globally.

Factors influencing the affordability of private health insurance

Private health insurance costs can vary significantly based on various factors. Let's explore how these factors impact the affordability of private health insurance.

Age

As individuals age, the risk of developing health issues increases, leading to higher premiums for older individuals. Younger people generally pay lower premiums as they are considered lower risk by insurance companies.

Location

The cost of healthcare can vary depending on the region or state you reside in. Areas with higher healthcare costs may result in higher insurance premiums to cover the increased expenses.

Pre-existing Conditions

Individuals with pre-existing health conditions may face higher premiums or even exclusions from coverage. Insurance companies consider these individuals higher risk and adjust premiums accordingly.

Level of Coverage, Deductibles, and Co-pays

The extent of coverage, deductibles, and co-pays chosen by individuals can significantly impact the cost of private health insurance. Higher coverage levels and lower deductibles often come with higher premiums.

Risk Factors and Premium Determination

Insurance companies assess various risk factors such as age, lifestyle, medical history, and occupation to determine premiums. Those with higher risk factors may face increased premiums, affecting the affordability of private health insurance.

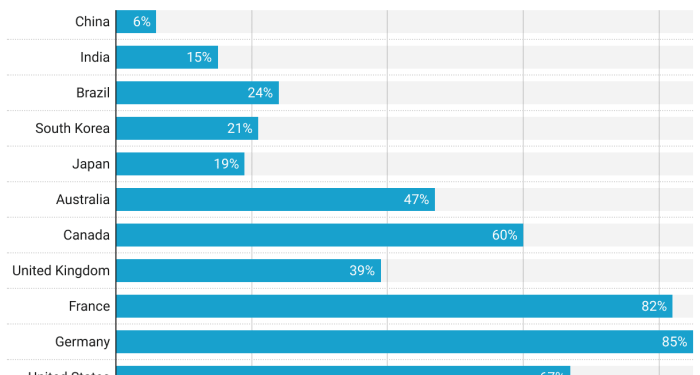

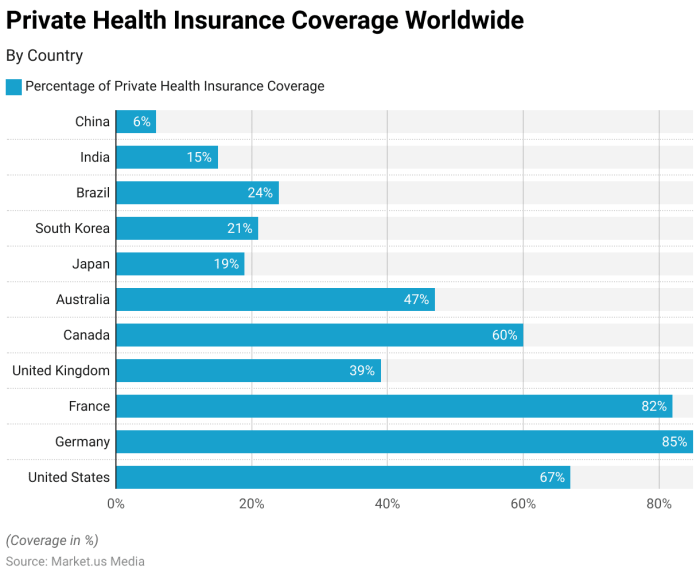

Comparison of private health insurance costs in different countries

Private health insurance costs vary significantly across different countries, influenced by factors such as healthcare system efficiency, government regulations, and overall cost of living. Here, we will explore examples of countries known for offering affordable private health insurance options and contrast the costs between developed and developing nations.

Affordable Private Health Insurance Options

- In countries like Germany, the Netherlands, and Switzerland, private health insurance options are known to be relatively affordable compared to other developed nations.

- Australia and New Zealand also offer a mix of private and public health insurance options, with some affordable choices for individuals and families.

- In developing countries like Thailand and Malaysia, private health insurance costs are generally lower compared to developed nations, making it more accessible to a wider population.

Contrast Between Developed and Developing Countries

- In developed countries such as the United States, private health insurance costs can be significantly higher due to the complex healthcare system and higher medical expenses.

- Developing countries like India and Indonesia have lower private health insurance costs, but coverage and quality of care may vary, impacting affordability for different income groups.

Government Regulations and Healthcare Systems Impact

- Government regulations play a crucial role in determining the affordability of private health insurance by setting standards for coverage, pricing, and competition among insurers.

- Countries with universal healthcare systems or strong government involvement often have lower private health insurance costs, as the public sector helps regulate pricing and provide basic coverage.

- In contrast, countries with more privatized healthcare systems may see higher private health insurance costs, as market forces and competition drive pricing without government intervention.

Strategies for finding the best deals on private health insurance

When it comes to finding the best deals on private health insurance, there are several strategies that individuals can use to ensure they are getting the most affordable option that meets their needs. Understanding policy terms, coverage limits, and exclusions is crucial in making an informed decision.

Leveraging employer-sponsored insurance or group plans can also help in reducing the cost of private health insurance.

Comparing Different Insurance Plans

- Compare premiums: Look at the monthly premium costs for different plans and evaluate what fits within your budget.

- Assess coverage options: Understand what services are covered under each plan to ensure it meets your healthcare needs.

- Consider deductibles and copays: Take into account the out-of-pocket costs you will incur when using the insurance plan.

- Check network providers: See if your preferred doctors and hospitals are included in the plan's network to avoid additional costs.

Understanding Policy Terms and Coverage Limits

- Read the fine print: Pay attention to the details of the policy to understand what is covered and what is excluded.

- Know the coverage limits: Be aware of any limits on benefits, such as maximum coverage for certain procedures or treatments.

- Review exclusions: Understand what services or conditions are not covered by the insurance plan to avoid surprises later on.

Leveraging Employer-Sponsored Insurance or Group Plans

- Check if your employer offers insurance: Many companies provide group health insurance plans that can be more cost-effective than individual plans.

- Compare benefits: Evaluate the benefits offered by your employer's plan and see if it aligns with your healthcare needs.

- Consider contribution amounts: Assess how much you will need to contribute towards the premium costs and factor that into your decision.

Impact of the healthcare system on private health insurance affordability

The structure of a country's healthcare system plays a crucial role in determining the availability and cost of private health insurance. Let's delve into how different aspects of the healthcare system can influence the affordability of private health insurance.

Role of Public Healthcare Programs

Public healthcare programs can significantly impact the affordability of private health insurance. In countries where public healthcare is robust and covers a wide range of medical services, individuals may rely less on private insurance for basic healthcare needs. This can create a more competitive market for private insurers, leading to lower premiums and more affordable options for consumers.

Competitive Insurance Market

A competitive insurance market can also contribute to more affordable private health insurance options. When there are several insurance providers vying for customers, insurers may offer competitive pricing and a variety of coverage options to attract policyholders. This competition can drive down costs and make private health insurance more affordable for individuals and families.

Regulatory Environment

The regulatory environment in a country can also impact the affordability of private health insurance. Regulations that require insurers to cover certain benefits or limit the amount they can charge for premiums can help make private insurance more accessible and affordable for consumers.

On the other hand, overly restrictive regulations may stifle competition and lead to higher costs for policyholders.

End of Discussion

Concluding our exploration of the best countries for affordable private health insurance, we've delved into the key aspects that impact insurance costs and highlighted ways to navigate the system effectively. Remember, informed decisions lead to better health coverage options.

Questions and Answers

Which countries are known for offering affordable private health insurance?

Some countries known for providing affordable private health insurance options include Germany, the Netherlands, and Switzerland.

How can individuals find the most affordable private health insurance plans?

Individuals can compare different insurance plans, understand policy terms thoroughly, and consider leveraging employer-sponsored or group plans to reduce costs.

Do government regulations play a significant role in private health insurance affordability?

Yes, government regulations can impact the affordability of private health insurance by influencing pricing, coverage options, and accessibility.